Both Shylea Ulrick and Lifestyle Advisers are authorised representatives of AvalonFS AFSL 437518.

Financial Adviser

Shylea Ulrick

At Lifestyle Advisers, our focus is centred on helping you achieve your desired lifestyle! For us to effectively assist you to achieve this, we look beyond the numbers and consider your overall position including such factors as job security, family plans, short-term and long-term goals and any other factors that will impact on your desired outcomes. What this means in real terms is: we need to know who you are as a person! We want to know all about you! Equally, we want you to know us as individuals as well! Feel free to ask us about who we are, we are happy to welcome you as part of our friendship fold, not keep you at arms length as a ‘customer’!

To review what you should be looking at when searching for a financial planner, please have a look at our article on Seeking Financial Advice and from this, you will find that we are a sound practice that has a lot to offer towards your financial security.

We service Canberra, Sydney, Newcastle, Bega Valley, Orange and Central West NSW, Merimbula, Eurobodalla and Bundaberg. While we are happy to do business via the internet, we know the value of a face to face meeting and will facilitate this whenever possible.

How May I Help You?

You might think that you are ready for anything, but until ‘anything’ hits you in the face and demands you to respond, how do you know you are ready? Take a step back and ask yourself if you really are ready for anything!

Do you think you are too young to worry about retiring?

Planning for retirement can start from the first day you commence work! While most of us are not thinking about retirement until it is almost upon us, getting a head start could bring your retirement day earlier or set you up for a better lifestyle during retirement.

Your retirement plan should also include a strategy of how you will retire.

We can provide advice on investment and superannuation strategies that can help you achieve your lifestyle goals for retirement.

No matter what age you are, if you have a robust strategic plan in place for your retirement, you can retire on your terms with the lifestyle you dream about. Our financial planning service is very much about achieving your dream lifestyle! Start now to live the life you want rather than working for the life you aren’t happy with.

“If it is compulsory, it isn’t meant to work for me…”

While super may be compulsory, not all funds are the same and the result you will get at the end may not have been what you thought.

You may also need to consider just how much you are contributing to your super fund. It may be that it’s not enough when the time comes to use it!

Being advised on the right fund for you and the outcomes self-contributions could make may put that golden lining on your retirement lifestyle.

As your financial planner, we consider the lifestyle you want to achieve and set you up with a super fund that will work for you and put you on the path to achieving your goals!

“Investing is only for the rich”…. NOT TRUE

A sound investment portfolio can set you up for life, but with so many choices, it is not always easy to know where to put your money to ensure the right returns for your lifestyle plan. Having clear goals and a well laid out investment and savings plan will ensure that you can accumulate the wealth that will support the lifestyle you desire.

The death of a loved one can be stressful for a family both emotionally and financially. How will your family cope financially, if you are ill, injured or no longer around?

We can provide advice on options available to you to help provide a safety net for you and your family in the event of sickness, disability or death.

Do you have a plan in place for the distribution of your assets when you are gone? Are your assets going to be left to the people that you want them to go to? Are the strategies appropriate for tax effectiveness? Have all debts associated with assets been accounted for?

We can help you plan your estate for the best outcomes for you and your family.

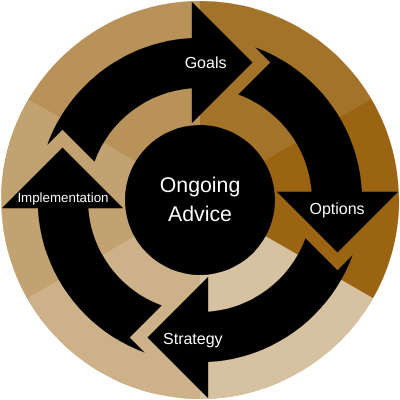

Our Process

The initial advice process covers our first appointment all the way through to the implementation of your financial plan.

From the Blog...

Why is ageing hard to talk about?

The topic of ageing may be difficult to bring up in conversation, but what happens when there is a crisis and important are required?

Thriving on social connection

by nature we are social creatures and connection is a core human need. So why do some many of us feel alone and what can we do to feel more connected?

Protect your identity

If your personal information falls into the wrong hands, it can be used to steal your identity. How secure is yours?

Sowing the seeds of succession

Succession planning can be difficult at the best of times without dealing with the added pressures farmers have recently faced with droughts, fires and floods.

The road ahead for shares

Trying to time investment markets is difficult if not impossible at the best of times, let alone now. The war in Ukraine, rising inflation and interest rates and an upcoming federal election have all added to market uncertainty and volatility.

Six savvy ways to get out of debt and get ahead

It’s easy to walk into debt, but so much harder to get out of it. Here are some practical steps to help you clear the debt!

We Sponsor...

Guide Dogs Australia

World Animal Protection

Sunrise Cambodia

Rural Aid Australia

Pancare Foundation